Sign up for The Wanderful newletter

Join our growing community of people looking to live the simple life!

Let’s build your van now

Join our growing community of people looking to live the Simple Life

)

How to insure a self-converted camper van is a difficult question to answer directly as the rules and regulations will vary greatly throughout each country and state/province.

My personal experience comes from insuring my van in the Canadian province of Manitoba. While my experience will differ greatly from those in the United States, Australia, New Zealand, and anywhere else in the world, there are key pieces of information that will be relevant for anyone looking to insure their DIY van conversion.

Before jumping in, it’s important to note that we are not insurance experts. This information is a collection of my personal experiences insuring self-converted Sprinter Vans in Manitoba, Canada as well as other (generally U.S.) vanlifers experiences that I’ve learned about along the way.

Before you even begin your van conversion project, find an insurance broker who can help you determine the best way to handle your coverage. Give them an idea of what upgrades you’re looking to do in your van and learn about the criteria you may need to consider in your build, as well as what information you should be documenting along the way.

Collecting as much information as possible upfront will help you avoid future headaches and surprises down the road.

Ultimately your insurance broker should help you source a suitable insurance policy for your completed van conversion.

At this point, you’ll also want to insure the base vehicle as you normally would for any other vehicle.

You may feel the urge to withhold information out of fear of never finding the coverage you need for your self-converted van. The truth is, things will go wrong as soon as you’re in an accident. Your insurer can refuse to pay the insurance claim if they weren’t made aware of certain aspects of your build.

When your policy is being underwritten, be sure to tell them everything about your van build and what your intentions are with it. Otherwise, you could find yourself potentially on the hook for thousands of dollars, in the case of an accident or theft.

The insurance company may ask for purchase records in order to verify the new value of the vehicle. Track everything from the water tank and stove down to the nuts and bolts.

Option 1: Make a spreadsheet of everything you purchase and link to copies of the receipts.

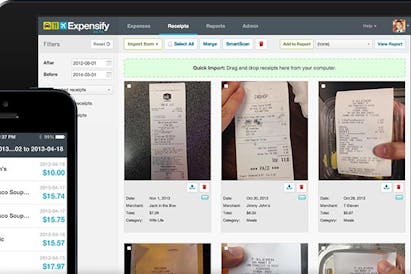

Option 2: Use an app like Expensify to keep track of all your purchases and categorize them in sections like Electrical, Cabinetry, Plumbing, etc.

Either way, try to keep it as organized as possible with the intention of handing the records over to other parties.

Many insurance companies will ask for photo evidence of your van conversion. Take ‘before and after’ photos of the van from all angles including the interior, exterior, undercarriage, and roof.

Note: With the photo evidence I provided to the insurance company, I was able to avoid a full inspection of my van.

Once you’ve finished converting your van, send your detailed expenses and photos to your insurance broker. With this information, the insurance company should be able to underwrite your new policy as a Motorhome, Camper Van or RV.

In some cases, the insurance company may want to do a physical inspection of the vehicle.

One thing to note here is that the new value of your van will only include the cost of the vehicle and any upgrades made to it. What it won’t include are the hours you put into the DIY conversion. Some companies may include the hours of labor from a professional van outfitter if you can provide an invoice showing the hours you paid for.

If your van is classified as something like a ‘Cargo Van’, you may want or need to reclassify it as a ‘Motorhome’ or ‘Camper Van’. This can help with the insurance underwriting process but is not always necessary.

This will vary from country and state, but to change the registration of your vehicle, you typically need to head to your state’s Department of Motor Vehicles (DMV) and provide the following:

Classifying your van as a motorhome has it’s own set of criteria which will vary from state to state and could include things like:

To avoid having to go back and adjust your build, this is something you should investigate well in advance.

A lot of the times, motorhome insurance policies will only cover what is fastened to the vehicle such as cabinets, solar, and electrical. Anything else that can be picked up and taken such as the fridge, computers, and cameras will generally fall under a separate policy.

Personal contents in the van can sometimes be covered under a Home insurance policy, while others will place it under a Personal Articles policy. Speak to your insurance broker to learn more about your options and what makes sense for your lifestyle.

As mentioned previously, be extremely honest when applying for this policy. The insurance company should be made aware that these items are going to be traveling and not spending a lot of time at a fixed address.

This number is a moving target and depends greatly on your country/state/province as well as the value of your vehicle and the upgrades you put into it.

You will need to speak to a local insurance agent to find out what your options are. For our American friends, we’ve been told that State Farm is most willing to work with DIY Van Builders.

In some states, insuring your camper van is straight forward, while others can feel impossible. My biggest piece of advice is to explore your options before jumping into the van conversion. The more educated you are upfront, the easier things will be after spending countless hours on a van build.

)

Are you about to kick off a journey of learning how to convert a van into a camper? Read this before wandering down the aisles of your local hardware store!

)

Thinking of building a bathroom in your self-converted van? Read this first!

)

Purchasing a used van is a great first step into #vanlife, and in theory, should be cheaper than purchasing a brand-spanking-new vehicle… Right?